Mortgages and Insurance

Outline what’s important to you.

We’ll help you get there.

Where a great mortgage rate is just the beginning.

Financial, lifestyle and family goal driven solutions.

Our team is committed to your long-term financial success.

“The team are top notch in every way. Always going above and beyond to stay ahead of the curve for their clients. Most people talk about it, but they actually do it. They define success and we are very fortunate to be able to work with them.” – Dave

“Professional, Personable, and Service Oriented. Anytime I recommend the Outline Financial team I know they will be welcomed with a friendly smile, treated with respect and get the information they need to make an educated and informed decision.” – Corrie

“I would like to take this opportunity to thank you all for your help and advice. Samantha, without your detailed explanation of budgeting, I would never have a clear picture of where I stand before making and offer. Joanna, without your advice, I would have given up on buying this home…just to let you know I am very grateful. Heather, you provided me lots of advice and help, and in the end, the rate worked out very well too, so thank you very much. Now that the closing is done…I am excited to plan for the future.” – Wayne

“The team is professional and knowledgeable in their field. Not only have they provided me with exceptional service, they have also given me excellent advice on related matters. The team is highly responsive and committed and I am pleased to provide them with a strong recommendation.” – Robin

“We want to thank you and your team! You not only provided us with a great mortgage…you and your team gave us peace of mind and that’s priceless!” – Melanie

“My wife and I have relied on Joanna and the team several times over the years to help us navigate the byzantine world of personal finance, debt management and mortgage renewals. They always strive to provide the best deal thoroughly customized to meet our needs. I would gladly recommend the team to anyone – and in fact, I have on several occasions.” – Adrian

“The Outline Financial team provided outstanding service for my client. They work fast, arranged the most suitable plan, and helped my client through the mortgage process. I recommend the team to anyone looking for a great advisor!” – Blair

“The team was an absolute pleasure to work with. They made the mortgage process the easiest part of homeownership. We were confident they would go above and beyond to get us the best rate – and they did. Their approach was professional and customer-focused. We knew we were in good hands from the beginning. I wouldn’t buy another house without them.” – Melissa

Our homes are what shape us. They’re more than a roof overhead. They’re the places we raise our children, celebrate with family, mourn loved ones lost and live life to the fullest. Buying a home is a unique responsibility, as well as an incredible opportunity.

https://www.outline.ca/wp-content/uploads/2024/04/InTheNews-1.jpg

845

1080

Jason Lang

https://www.outline.ca/wp-content/uploads/2019/08/websitelogo.png

Jason Lang2024-04-10 15:38:132024-04-10 15:45:20The Bank of Canada maintains policy rate

https://www.outline.ca/wp-content/uploads/2024/04/InTheNews-1.jpg

845

1080

Jason Lang

https://www.outline.ca/wp-content/uploads/2019/08/websitelogo.png

Jason Lang2024-04-10 15:38:132024-04-10 15:45:20The Bank of Canada maintains policy rate https://www.outline.ca/wp-content/uploads/2024/04/InTheNews.jpg

845

1080

Jason Lang

https://www.outline.ca/wp-content/uploads/2019/08/websitelogo.png

Jason Lang2024-04-03 20:57:172024-04-03 20:57:17Update on Ontario Budget 2024

https://www.outline.ca/wp-content/uploads/2024/04/InTheNews.jpg

845

1080

Jason Lang

https://www.outline.ca/wp-content/uploads/2019/08/websitelogo.png

Jason Lang2024-04-03 20:57:172024-04-03 20:57:17Update on Ontario Budget 2024 https://www.outline.ca/wp-content/uploads/2024/02/InTheNews-1.jpg

845

1080

Jason Lang

https://www.outline.ca/wp-content/uploads/2019/08/websitelogo.png

Jason Lang2024-02-01 21:00:052024-02-01 21:24:14January 2024: In the News

https://www.outline.ca/wp-content/uploads/2024/02/InTheNews-1.jpg

845

1080

Jason Lang

https://www.outline.ca/wp-content/uploads/2019/08/websitelogo.png

Jason Lang2024-02-01 21:00:052024-02-01 21:24:14January 2024: In the News https://www.outline.ca/wp-content/uploads/2024/01/InTheNews-4.jpg

845

1080

Jason Lang

https://www.outline.ca/wp-content/uploads/2019/08/websitelogo.png

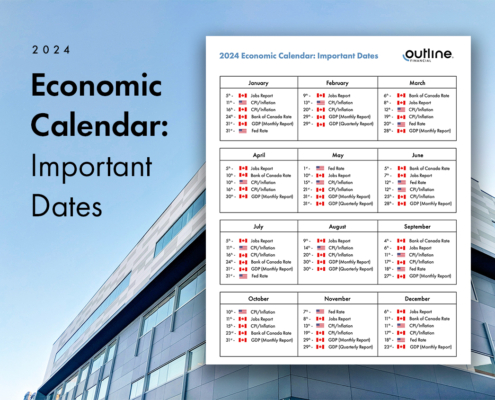

Jason Lang2024-01-25 20:17:252024-02-01 15:39:322024 Economic Calendar: Important Dates

https://www.outline.ca/wp-content/uploads/2024/01/InTheNews-4.jpg

845

1080

Jason Lang

https://www.outline.ca/wp-content/uploads/2019/08/websitelogo.png

Jason Lang2024-01-25 20:17:252024-02-01 15:39:322024 Economic Calendar: Important Dates

https://www.outline.ca/wp-content/uploads/2023/10/InTheNews-2.jpg

845

1080

Jason Lang

https://www.outline.ca/wp-content/uploads/2019/08/websitelogo.png

Jason Lang2023-10-25 14:05:292023-10-26 13:47:58The Bank of Canada maintains policy rate

https://www.outline.ca/wp-content/uploads/2023/10/InTheNews-2.jpg

845

1080

Jason Lang

https://www.outline.ca/wp-content/uploads/2019/08/websitelogo.png

Jason Lang2023-10-25 14:05:292023-10-26 13:47:58The Bank of Canada maintains policy rate

Outline Financial is one of Canada’s top-rated mortgage and insurance companies offering direct access to rate and product options from over 30 banks, credit unions, mono-line lenders and insurers all in one convenient service. The Outline team was formed by senior level bankers and financial planners that wanted to offer clients choice with an exceptional service experience.

Tel: (416) 536-9559

Email: hello@outline.ca

Click here to book a call

Outline Financial – Head Office

465 King Street East – Suite 15

Toronto, ON M5A 1L6

(King & Parliament)

Outline Financial – Carlaw Avenue

326 Carlaw Ave – Suite 103

Toronto, ON M4M 2R6

(Carlaw & Eastern)

Outline Financial – Ottawa Office

90 Richmond Rd – Suite H

Ottawa, ON K1Z 6V9

(Richmond & Island Park Dr.)

Outline Financial – Calgary Office

330 – 5th Avenue SW, Tower 1, Suite 1800

Calgary, AB T2P 0L4

FSRA (Ontario) Mortgage Brokerage Licence #13151

RECA (Alberta) Mortgage Brokerage Licence #00576717

FSRA Life Insurance and Accident and Sickness Insurance Agent License #36641M